If your financial apps are slow or hard to navigate, you should drop them and move to Zelle. If you are concerned about the security of your financial information, you should ditch your old money transfer app and shift to Zelle. Reason? Well, Zelle has established an impression into the market as one of the trustworthy quick pay apps existing at the moment.

As per a report shared by Statista, Zelle helped in moving $133 billion in the first half of 2020. In 2017, Q3 and Q4 had witnessed the movement of $17.5 and $22 billion, respectively, through Zelle.

In this blog, we are reviewing Zelle bank transfer app in detail along with its features and history. The review will help you understand the reason behind its growing popularity. Moreover, if you are a developer looking for inspiration, you can use this Zelle money review to know about the app in detail and frame your app development strategy accordingly. However, it is advised for you that you should still get your app reviewed by experts once it is built to know if it lacks something.

Zelle was known as clearXchange before it became Zelle in 2017. clearXchange had its beginning in 2011 and was owned by Bank of America, JPMorgan Chase, and Wells Fargo. The payment service offered a money transfer network between participating banks and through a website. However, in 2016, clearXchange was sold to Early Warning Services. Moving forward in 2017, clearXchange became Zelle and all of its users had to recreate their profiles to continue the consumption of its payment services.

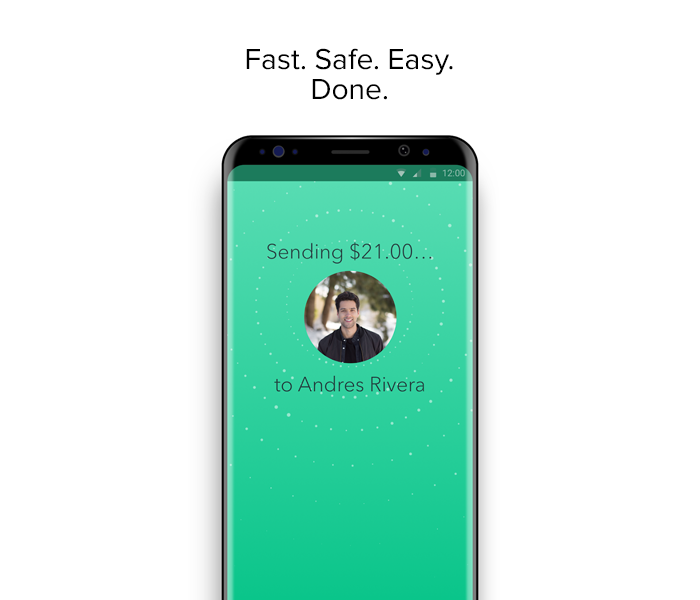

Zelle is one of the best payment apps that has been designed according to the financial needs of modern users. The app is safe and free to use. Moreover, to make it user-friendly, the app focuses on maintaining the accessibility of its features and navigation. Now, to understand the features of Zelle payment app in detail, let’s break them down into a few points.

Zelle app is designed to make sure that the money transfer process does not take more than a few minutes by working as a peer-to-peer payment app. And the best part is, it’s pretty easy to start. If the receiver and the sender both have Zelle, the money gets transferred instantly. However, in the case where the receiver does not have Zelle quick pay app, they need to follow easy instructions for the first time to receive it.

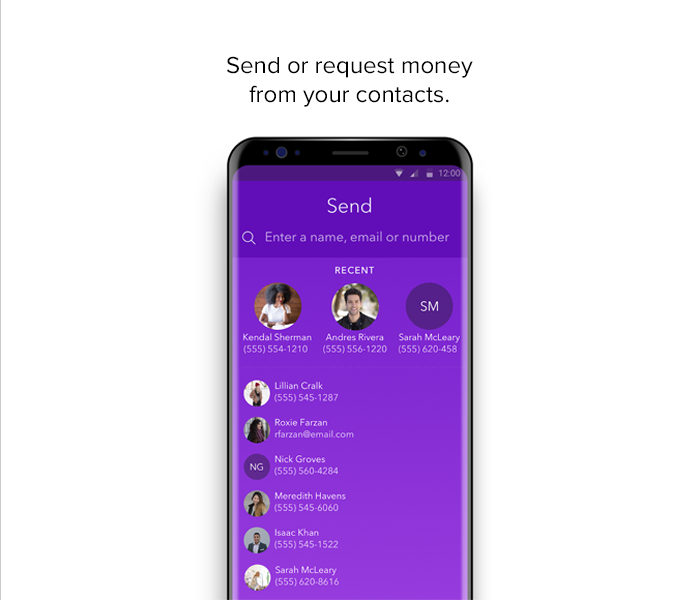

Enrolling in Zelle banking app is a piece of cake. Users can either sign up on the app through Visa or Mastercard debit cards linked to US-based bank accounts, or they can use internet banking details if their banks support it. Following any of the above steps will link the banking details into Zelle payment app for transactions even in the future unless users want to remove or change account details.

With features such as email money transfer, Zelle makes sure that sending money is not a hectic task. You can even send money to the users who are not on Zelle. They can simply use the information you used to transfer money for Zelle's registration process and receive the amount.

Zelle cash app takes cybersecurity seriously. Therefore, the app makes sure that the financial information stored in the app is secured and free from risks such as data leaks, malware, etc. As names such as Bank of America, Capital One, and Wells Fargo, among others are affiliated with the app, that says something, doesn’t it?

Zelle has multiple banks supporting transactions through the app. However, there are a few limitations each bank has decided on the transfer values. Let’s have a look at them.

Zelle transfer limits

| Bank | Daily limit (USD) | Monthly limit (USD) |

|---|---|---|

| Chase Personal Checking | 2,000 | 16,000 |

| Chase Business Checking or Chase Private Client app | 5,000 | 40,000 |

| Ally Bank | 5,000 | 10,000 |

| Citizens Bank | 1,000 | 5,000 |

| PNC Bank | 1,000 | 5,000 |

| Wells Fargo | 2,500 | 20,000 |

Zelle app is almost perfect, but it still lacks a few things that might grow it exponentially.

Let’s have a look at the bright side first though!

Additional information on Zelle app

Features- 4.4

Pricing- 4.9

Navigation- 4.8

Security- 4.7

These features that we discussed above are the reason why Zelle quickly made its place among one of the best payment apps functioning in the US. However, there are a few limitations this app has, therefore, its alternatives like Venmo might still have the lead. But as Zelle has more reliable brands backing it up, it might lead the banking app market in the future if it tackles the opportunity and adds more usable features.

Cut to the chase content that’s credible, insightful & actionable.

Get the latest mashup of the App Industry Exclusively Inboxed